In the high-stakes world of business, one crucial calculation can make all the difference between success and failure: the break-even point. It’s the holy grail of financial metrics, the point at which your business’s revenue equals its total fixed and variable costs, and profitability becomes a reality. Yet, for many entrepreneurs and small business owners, calculating the break-even point remains a daunting task, shrouded in mystery and complexity. But fear not! With this comprehensive guide, you’ll learn how to demystify the break-even point, and unlock the secrets to financial sustainability. From understanding the key components of your business’s cost structure, to mastering the step-by-step calculation process, we’ll take you on a journey to uncover the precise point at which your business turns a profit, and sets you on the path to long-term success.

Understanding the break-even point: Definition and importance

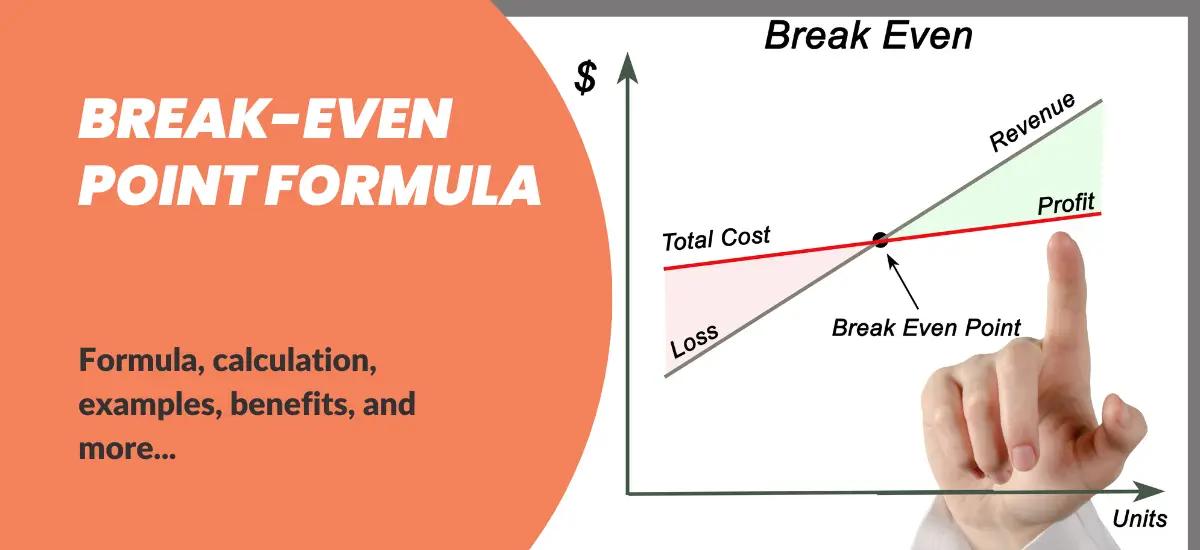

The break-even point is a crucial milestone in the life of any business, marking the moment when revenue finally equals expenses, and profitability begins to take hold. It’s the point at which a business ceases to be a drain on resources and starts to generate a return on investment. But what exactly is the break-even point, and why is it so important? In essence, the break-even point is the point at which a company’s total revenue equals its total fixed and variable costs, resulting in neither profit nor loss. It’s the point at which a business has reached a state of equilibrium, where the income generated is sufficient to cover all expenses, but not yet generating a surplus. Understanding the break-even point is vital because it allows business owners to make informed decisions about pricing, production, and investment.

Why is Calculating Your BEP Important?

There are several reasons why calculating your BEP is vital for any business:

Financial planning: Knowing your BEP helps you set realistic sales targets and understand how much you need to sell to cover your costs.

Pricing strategy: The BEP can inform your pricing strategy. By factoring in your costs and desired profit margin, you can set prices that ensure you reach your break-even point and move into profitability.

Cost control: The BEP analysis process encourages you to scrutinize your costs and identify areas for potential savings.

Decision-making: Understanding your BEP allows you to make informed decisions about marketing budgets, product launches, and resource allocation.

Identifying your business’s cost structure: Fixed and Variable costs

As you embark on the journey to calculate your break-even point, it’s essential to understand the intricacies of your business’s cost structure. This crucial step lays the foundation for accurate calculations and informed decision-making. Your cost structure is comprised of two primary components: fixed costs and variable costs. Fixed costs are the expenses that remain constant, regardless of production or sales levels. These include rent, salaries, insurance, and equipment costs, among others. They are the backbone of your business, providing the necessary infrastructure for operations. On the other hand, variable costs are directly tied to production and sales volumes. They fluctuate in response to changes in output, such as raw materials, labor, and marketing expenses. Understanding the interplay between these two cost categories is vital, as it will help you pinpoint areas where cost reductions can be made, and ultimately, determine your break-even point.

Calculating the break-even point: A Step-by-step guide

Calculating the break-even point is a crucial step in determining the financial viability of your business. It’s a critical metric that helps you understand when your business will start generating profits, and it’s essential to get it right. To calculate your break-even point, you’ll need to gather a few key pieces of information, including your fixed costs, variable costs, and the selling price of your product or service. Once you have these numbers, you can plug them into a simple formula to get your break-even point. There are two main formulas for calculating your break-even point, each with a slightly different approach:

Formula 1: Break-even point in units

This formula is ideal if you sell a single product or service at a uniform price.

BEP (Units) = Total Fixed Costs / (Selling Price per Unit – Variable Cost per Unit)

Let’s break it down:

Total fixed costs: These are expenses that remain constant regardless of your sales volume, such as rent, salaries, insurance, and loan payments.

Selling price per unit: This is the price at which you sell your product or service.

Variable cost per unit: These are expenses that vary directly with your sales volume, such as materials, labor, and commissions.

Example:

Imagine you run a bakery and your total fixed costs are $5,000 per month. Your cupcakes sell for $3 each, and your variable cost per cupcake (including ingredients and packaging) is $1.50.

BEP (Units) = $5,000 / ($3 – $1.50)

BEP (Units) = $5,000 / $1.50

BEP (Units) = 3,333.33 cupcakes

This means you need to sell approximately 3,333 cupcakes each month to cover your costs and break even.

Formula 2: Break-even point in sales dollar

This formula is useful if you sell a variety of products or services at different prices.

BEP (Sales Dollars) = Total Fixed Costs / Contribution Margin Ratio

Understanding the Components:

Contribution margin ratio: This ratio represents the percentage of each sales dollar that contributes to covering fixed costs and generating profit after variable costs are accounted for.

To calculate the Contribution Margin Ratio, follow this formula:

Contribution Margin Ratio = (Selling Price per Unit – Variable Cost per Unit) / Selling Price per Unit

Example:

Going back to our cupcake example, we know the selling price per cupcake is $3 and the variable cost per unit is $1.50.

Contribution Margin Ratio = ($3 – $1.50) / $3

Contribution Margin Ratio = $1.50 / $3 = 0.5 or 50% (This means 50% of each sales dollar goes towards covering fixed costs and generating profit)

Now, let’s plug this value back into the main formula:

BEP (Sales Dollars) = $5,000 / 0.5

BEP (Sales Dollars) = $10,000

This indicates that you need to generate $10,000 in total sales each month to reach your break-even point

Interpreting your results: What your break-even point reveals about your business

Once you’ve crunched the numbers and calculated your break-even point, it’s time to dig deeper into the insights it reveals about your business. This crucial metric is more than just a numerical value – it’s a window into the financial health and viability of your organization. A low break-even point indicates that your business can quickly recover its costs and start generating profits, while a high break-even point may suggest that your prices are too low, your costs are too high, or your sales strategy needs a revamp. Analyzing break-even point, helps in identify areas for improvement, optimize your pricing and production strategies, and make informed decisions about investments and resource allocation. Your break-even point can also serve as a benchmark to measure the effectiveness of your business strategies over time, helping you to refine your approach and drive long-term success.

Using your break-even point to drive business growth and profitability

With your break-even point calculated, you now hold the key to unlocking the full potential of your business. This crucial metric serves as a compass, guiding you towards informed decisions that drive growth, profitability, and sustainability. Understanding the precise point at which your business becomes profitable, can help in adjust your pricing strategy, optimize production costs, and identify opportunities to increase revenue. You can fine-tune your marketing efforts, targeting high-value customers and channels that yield the greatest returns. Moreover, your break-even point provides a benchmark for measuring the success of new initiatives, allowing you to pivot or scale accordingly. As you continue to monitor and analyze your break-even point, you’ll be empowered to make data-driven decisions, streamline operations, and propel your business towards long-term success.

Important considerations

Accuracy of data: The accuracy of your BEP calculation depends on the accuracy of your cost data. Ensure you have a clear understanding of your fixed and variable costs.

Dynamic nature of business: Your BEP is not a static number. As your business evolves, your costs and sales prices may change. It’s crucial to periodically recalculate your BEP to reflect these changes and maintain an accurate understanding of your financial standing.

Limitations of BEP: The BEP formula assumes a linear relationship between costs and sales volume. In reality, costs may not increase or decrease perfectly in proportion to sales. Additionally, the BEP doesn’t factor in external factors like market fluctuations or competitor actions.

Beyond BEP: While the BEP is a valuable metric, it’s just one piece of the financial puzzle. Your ultimate goal is to surpass your BEP and generate a profit. Use your BEP calculation as a springboard for further financial planning and strategies to maximize your profit potential.

Leveraging your break-even point

Once you’ve calculated your BEP, you can leverage this information to make informed business decisions:

Pricing strategy: Review your BEP alongside your desired profit margin to determine optimal pricing strategies.

Cost management: Identify areas where you can potentially reduce variable costs to lower your BEP and improve profitability.

Sales forecasting: Use your BEP to set realistic sales targets that ensure you cover your costs and move into a profit zone.

Marketing and advertising: Allocate marketing and advertising resources strategically to generate the sales volume necessary to reach your BEP and achieve profitability.

Conclusion

As you’ve seen, calculating your break-even point is a crucial step in understanding the financial health of your business. Remember, knowing your break-even point is not just about crunching numbers – it’s about understanding the delicate balance between revenue and expenses that will ultimately determine your business’s success. With this knowledge, you’ll be able to identify areas for improvement, optimize your operations, and make strategic financial decisions that will propel your business forward. So, take control of your finances today and start calculating your break-even point. Your business will thank you.