Inventory management is the unsung hero that can make or break a company’s bottom line. Effective inventory management is the delicate balance between having enough stock on hand to meet customer demand and avoiding costly overstocking. But, without a solid grasp of essential inventory management formulas, even the most well-intentioned business owners can find themselves lost in a sea of stockouts, overstocking, and missed opportunities. By mastering these critical formulas, you can unlock the secrets to optimizing your inventory, reducing costs, and driving business growth. In this post, we’ll dive into the essential inventory management formulas you need to know to take your business to the next level, and provide you with the tools and expertise to make data-driven decisions that drive success.

Understanding the importance of inventory management formulas

In the world of inventory management, numbers are everything. Accurate calculations and precise forecasting are the keys to unlocking a well-oiled supply chain, minimizing stockouts, and maximizing profits. At the heart of this process lie essential inventory management formulas, which serve as the guiding principles for making informed decisions about stock levels, reorder points, and lead times. Without a deep understanding of these formulas, businesses risk being bogged down by inventory imbalances, inefficient use of resources, and lost revenue opportunities. Mastering these formulas, inventory managers can gain a competitive edge, streamline operations, and ultimately, drive business success.

Essential inventory management formulas every business owner should know

#1: Inventory Turnover Ratio

The metric reveals how many times you sell your entire inventory within a specific period, typically a year. A higher ratio indicates efficient inventory management, with products selling quickly and not sitting on shelves.

The formula to calculate the inventory turnover ratio is as follows:

Inventory turnover ratio = Cost of goods sold (COGS) / Average inventory

COGS = Beginning inventory + Inventory purchases – Ending inventory

Average inventory = Beginning inventory value + End inventory / 2

For example: Imagine a clothing store that sells dresses.

Cost of Goods Sold (COGS): Let’s say the store sold $25,000 worth of dresses in a year.

Average Inventory: Suppose the store maintains an average inventory of $10,000 throughout the year. This reflects the average value of dresses they have in stock at any given time.

Calculation:

Inventory Turnover Ratio = COGS / Average Inventory

Inventory Turnover Ratio = $25,000 / $10,000

Inventory Turnover Ratio = 2.5

Interpretation: In this example, the inventory turnover ratio is 2.5. This means the store has sold and replaced its entire stock of dresses 2.5 times within a year. This indicates a relatively healthy inventory turnover, suggesting the store is efficiently managing its stock and avoiding excessive dead stock.

#2: Gross Margin Return on Investment (GMROI)

This metric tells you how much profit you generate for every dollar invested in inventory. A higher GMROI signifies greater profitability, helping you identify the most lucrative products.

The formula to calculate GMROI is as follows:

GMROI = Gross margin / Average inventory cost x 100

For example, an electronics store that sells laptops.

Gross Margin: The store has a gross margin of $30,000 on laptops sold throughout a year. This means they profited $30,000 after covering the cost of the laptops they sold.

Average Inventory Cost: The store maintains an average inventory cost of $20,000 for laptops throughout the year. This represents the average amount of money invested in laptops sitting in stock at any given time.

Calculation:

GMROI = $30,000 / $20,000 x 100

GMROI = 1.5 x 100

GMROI = 150%

Interpretation: In this scenario, the electronics store has a GMROI of 150%. This indicates that for every dollar invested in laptop inventory (average cost of $20,000), they generate a gross profit of $1.50. A higher GMROI like this suggests the store is efficiently selling laptops and making a good profit on their inventory.

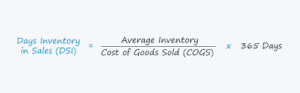

#3: Days Sales of Inventory (DSI)

DSI tells you how long it takes, on average, to sell your stock. A lower DSI indicates faster inventory turnover, which is generally desirable.

The formula to calculate DSI is as follows:

DSI = (Average Inventory / COGS) x 365 days

For example, a bookstore that sells a variety of fiction and non-fiction books.

Inventory Level: The bookstore has 15,000 books in their inventory (units can be individual books or sets).

Cost of Goods Sold (COGS): The total cost of books they purchased throughout a year is $45,000.

Calculation:

DSI = (15,000 books / $45,000) x 365 days

DSI = (1/3) x 365 days

DSI = 121.67 days (approximately)

Interpretation: The bookstore’s DSI is approximately 121.67 days. This indicates that, on average, it takes them roughly 122 days to sell their entire stock of books. This could be a reasonable turnover rate for bookstores depending on the industry and book types.

#4: Inventory Holding Cost

This metric highlights the expenses associated with storing your inventory, including warehousing, insurance, and others. Ideally, you want to keep these costs below 20-30% of your inventory’s annual value.

The formula is as follows:

Inventory holding cost = Warehousing + Labor + Opportunity cost + Depreciation / Inventory value x 100

For example, a store that sells craft supplies and art materials.

Storage Costs: The store spends $3,000 annually on renting warehouse space to store their inventory.

Employee Wages: $4,000 is allocated annually for staff wages related to managing and handling inventory.

Security & Insurance: An annual cost of $1,500 is dedicated to security and insurance for the inventory.

Miscellaneous Costs: There are additional expenses of $2,500 per year associated with depreciation, utilities, and other miscellaneous costs related to holding inventory.

Calculation:

Total Cost = Storage + Wages + Security + Miscellaneous

Total Cost = $3,000 + $4,000 + $1,500 + $2,500

Total Cost = $11,000

Inventory Value: Suppose the average value of the craft supplies inventory throughout the year is $40,000.

Inventory Holding Cost = Total Inventory Holding Costs / Inventory Value x 100

Inventory Holding Cost = $11,000 / $40,000 x 100

Inventory Holding Cost = 0.275 x 100

Inventory Holding Cost = 27.5%

Interpretation: In this example, the craft supply store’s inventory holding cost is estimated to be 27.5%. This signifies that for every $100 worth of inventory they hold on average throughout the year, they incur storage, labor, and other holding costs of $27.50.

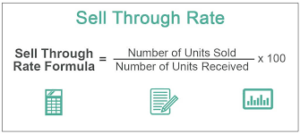

#5: Inventory Sell-Through Rate

This metric shows how much of your received inventory you sell within a specific timeframe. A higher sell-through rate suggests strong product-market fit and helps identify top-performing products.

The formula to calculate the inventory sell-through rate is as follows:

Inventory sell-through rate = Total units sold / Number of units received x 100

For example, a shoe store that tracks its inventory for a specific month (let’s say July).

Units Sold: The shoe store sold 3,000 pairs of shoes in July.

Units Received: They received 4,500 pairs of shoes from their suppliers in July.

Calculation:

Inventory Sell-Through Rate = 3,000 pairs / 4,500 pairs x 100

Inventory Sell-Through Rate = 0.667 x 100

Inventory Sell-Through Rate = 66.7% (approximately)

Interpretation: The shoe store’s inventory sell-through rate for July is approximately 66.7%. This signifies that they were able to sell roughly 67 out of every 100 pairs of shoes they received in that month. This could be a positive indicator, suggesting strong demand for their shoe selection.

How to apply inventory management formulas to real-world scenarios?

Applying inventory management formulas to real-world scenarios is where the rubber meets the road. It’s one thing to understand the formulas, but it’s another to effectively implement them in your daily operations. Let’s revisit the Dress Boutique scenario and see how these formulas can be used in practice.

Inventory Turnover Ratio: We calculated the boutique’s ratio to be 2.5, indicating they sell their entire stock of dresses 2.5 times a year. This suggests efficient inventory management, with dresses selling quickly and avoiding dead stock.

Gross Margin Return on Investment (GMROI): Assuming a 40% gross margin on dresses, we estimated a GMROI of 100%. This implies that for every dollar invested in inventory, they generate $1 in gross profit. However, this is an estimate, and the actual GMROI might differ depending on the exact cost of dresses.

By analyzing these metrics, the boutique owner can make informed decisions. A high inventory turnover ratio might suggest they can handle a slightly larger stock selection to cater to diverse customer preferences. Conversely, a lower GMROI might prompt them to investigate dress cost optimization or explore higher-margin dress lines. Inventory formulas empower retailers to make data-driven choices. From optimizing stock levels to minimizing stockouts, these calculations translate theory into practical improvements. Whether you’re a boutique owner or a large-scale retailer, mastering these formulas can give you a significant edge in today’s competitive market.

Common inventory management formula mistakes and how to avoid them

When it comes to inventory management, even the slightest miscalculation can have a significant impact on your business’s bottom line. A single mistake in a formula can lead to stockouts, overstocking, and a host of other issues that can cost your company time, money, and resources. Unfortunately, these mistakes are more common than you might think. Many businesses struggle to accurately calculate their inventory levels, lead times, and reorder points, leading to a vicious cycle of inefficiency and waste. Let’s revisit the Dress Boutique example and see how common formula mistakes can be avoided:

Miscalculated Inventory Turnover: Imagine the boutique mistakenly included a discount rack of outdated dresses in their inventory valuation. This would inflate the average inventory value, leading to a lower-than-actual inventory turnover ratio. This might trick them into thinking they’re selling dresses slower than they are, potentially causing them to miss out on sales opportunities.

Flawed GMROI Calculation: Let’s say the boutique forgot to factor in hidden costs like garment bags or gift wrapping into their COGS calculation. This would underestimate their true cost of goods sold, leading to an inflated GMROI. This miscalculation could lead them to believe their dresses are more profitable than they actually are.

Here’s how the dress boutique can ensure accurate calculations:

Clearly Defined Inventory: Precise categorization of inventory ensures accurate valuation. Dresses should be separated by style, season, or any other relevant category to avoid including outdated items that skew calculations.

Cost Transparency: Factoring in all expenses related to the product is crucial. Including hidden costs like packaging materials in the COGS calculation gives a more accurate picture of profitability.

By being mindful of these potential pitfalls, the dress boutique, and any business for that matter, can leverage inventory formulas effectively. Remember, accurate data is the foundation for sound decision-making. Mastering these calculations empowers retailers to optimize stock levels, minimize waste, and ultimately achieve success.

Taking your business to the next level with data-driven inventory management decisions

The key to unlocking true success lies in leveraging the power of data-driven decision making. Mastering essential inventory management formulas, you’ll be able to transform your business from a reactive, intuition-based operation to a proactive, metrics-driven powerhouse. With the ability to accurately forecast demand, optimize stock levels, and identify areas of inefficiency, you’ll be empowered to make informed decisions that drive real results. Imagine being able to pinpoint exactly when to restock, how to allocate resources, and where to invest in process improvements. Harnessing the insights provided by inventory management formulas, you’ll be able to streamline your operations, reduce waste, and boost profitability. As you take your business to the next level, you’ll be able to respond to changing market conditions with agility, stay ahead of the competition, and ultimately, achieve sustainable growth and success.

Inventory formulas FAQ

As you delve into the world of inventory management, you’re likely to encounter a multitude of formulas and equations that can seem overwhelming at first. But fear not! With a little practice and patience, you’ll be a master of inventory management formulas in no time. In this section, we’ll address some of the most frequently asked questions about inventory formulas, providing you with a comprehensive guide to troubleshooting and optimizing your inventory management strategy.

- What is the difference between beginning inventory and ending inventory?

Beginning inventory is the value of the goods you have on hand at the start of a specific accounting period, while Ending inventory is the value of the goods you have on hand at the end of a specific accounting period.

- How do I calculate the cost of goods sold (COGS)?

COGS = Beginning Inventory + Purchases – Ending Inventory

- What is the inventory turnover ratio, and what does it tell me?

Inventory turnover ratio = COGS / Average Inventory Level. This ratio tells you how many times your inventory is sold and replaced over a period. A higher ratio indicates faster inventory turnover, which is generally good.

- How do I calculate my average daily demand?

Average daily demand = Total units sold / Number of days in the period

- What is the economic order quantity (EOQ)?

EOQ is a formula that helps determine the optimal order quantity to minimize total inventory holding and ordering costs. It’s a more complex formula that may require additional software or calculators.

- What is a safety stock, and how much do I need?

Safety stock is the extra inventory you hold to protect against unexpected changes in demand or supply lead times. There’s no one-size-fits-all answer, but it’s often calculated based on your average daily demand and lead time.

- What is the ABC analysis, and how can it help me manage inventory?

ABC analysis classifies inventory items into categories (A, B, and C) based on their annual value usage. This helps you focus your inventory management efforts on the most critical items (A items) that contribute the most to your overall cost.

How Selly Africa integrates inventory management formulas

Selly Africa, recognizing the power of data-driven inventory management, integrates essential inventory formulas into their solutions to empower businesses. Here’s how the platform leverage these formulas:

- Automated Calculations and Insights:

Inventory turnover ratio: Selly Africa’s software can automatically calculate this ratio for each product or category, providing real-time insights into how quickly inventory sells. This helps businesses identify potential issues like dead stock and make informed decisions about restocking or product removal.

GMROI analysis: Selly Africa’s system might not only calculate GMROI but also offer features to analyze these figures alongside historical data and sales trends. This empowers businesses to understand product profitability over time and optimize their inventory selection by focusing on high-margin items.

- Streamlined Inventory Management:

Days Sales of Inventory (DSI) tracking: Selly Africa’s software can track DSI for different periods (daily, weekly, monthly), allowing businesses to monitor inventory turnover rates and identify areas for improvement. This could suggest faster-selling inventory needs more frequent restocking, or slower-selling items might require adjusted ordering practices or potentially be discontinued.

Inventory Holding Cost management: Selly Africa’s solutions could factor in storage costs, labor costs associated with inventory management, and other expenses to estimate inventory holding costs. This provides businesses with valuable data to identify areas for cost reduction in their inventory management processes.

- Data-Driven Decision Making:

Inventory Sell-Through rate insights: Selly Africa’s platform might calculate and display inventory sell-through rates for specific products or categories. This helps businesses understand which products are in high demand and which might need adjustments in marketing, pricing, or promotions.

By integrating these inventory formulas and providing insightful data analysis, Selly Africa equips businesses with the tools to make informed inventory management decisions based on real data. This can lead to significant benefits, including:

Optimized stock levels: Businesses can ensure they have the right amount of inventory on hand, avoiding stockouts and overstocking.

Reduced costs: By identifying areas for cost reduction in storage, labor, and other holding costs, businesses can improve their overall profitability.

Increased efficiency: Streamlined inventory management processes with data-driven insights lead to faster order fulfillment and improved customer satisfaction.

Improved profitability: By focusing on high-margin products and optimizing stock levels, businesses can maximize their profits through data-driven inventory management.

Selly Africa’s focus on essential inventory formulas empowers businesses to make data-driven decisions, ultimately leading to a competitive edge in today’s fast-paced market.