In today’s digitally-driven world, the way we conduct business is undergoing a significant transformation. Gone are the days of cumbersome cash registers and bulky payment terminals, replaced by sleek, mobile payment solutions that empower entrepreneurs to take control of their sales process anywhere, anytime. For African businesses, this shift is particularly crucial, as it opens up new avenues for growth, innovation, and financial inclusion. Enter Selly Africa, a revolutionary mobile payment platform that enables merchants to accept credit card payments on their phones with ease. With Selly Africa, the limitations of traditional payment systems are a thing of the past, and the possibilities for business growth are endless. In this article, we’ll delve into the world of mobile payments, exploring how Selly Africa is democratizing access to credit card payments and empowering African businesses to thrive in the digital economy.

The rise of mobile payments in Africa

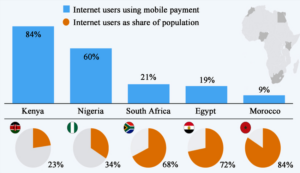

The landscape of commerce in Africa is undergoing a significant transformation, driven by the rapid growth of mobile payments. With the proliferation of mobile devices across the continent, more and more individuals are turning to their phones to make transactions, pay bills, and send money. This shift towards mobile payments is being fueled by the increasing demand for convenience, speed, and security in financial transactions. In Africa, where traditional banking infrastructure is often limited, mobile payments are providing a vital link to financial services for millions of people. The rise of mobile payments has also opened up new opportunities for businesses, enabling them to reach a wider customer base and expand their revenue streams. In this environment, innovative solutions like Selly Africa are emerging, providing merchants with the tools they need to accept credit card payments on their phones and tap into the vast potential of the mobile payments market.

Introducing Selly Africa: A game-changer for African businesses

The ability to accept credit card payments on the go has become a necessity for businesses to thrive. For far too long, African entrepreneurs and small business owners have been hindered by limited payment options, restrictive banking systems, and primitive transaction processes. But, with the advent of Selly Africa, the playing field has been leveled. This innovative mobile payment solution empowers businesses to accept credit card payments anywhere, at any time, using just their mobile phone. With Selly Africa, the boundaries of traditional payment systems are shattered, and the possibilities for growth and expansion are limitless. Whether you’re a street vendor, a small shop owner, or a budding entrepreneur, Selly Africa’s user-friendly platform and cutting-edge technology provide a seamless and secure way to process transactions, track sales, and manage your business on the go.

How to take credit card payments on your phone with Selly Africa

Imagine being able to make a sale anywhere, at any time, without the hassle of cumbersome payment machines or lengthy application processes. With Selly Africa, this is now a reality. This innovative mobile payment solution allows you to take credit card payments on your phone, effortlessly and securely. With just a few taps on your screen, you can process transactions, manage your sales, and track your earnings. Whether you’re a freelancer, entrepreneur, or small business owner, Selly Africa gives you the freedom to accept credit card payments on-the-go, making it easier to grow your business and reach new customers. With its user-friendly interface, competitive rates, and robust security features, Selly Africa is the perfect solution for anyone looking to take their business to the next level. Here’s a breakdown of the steps to make mobile credit card payments a reality for your online store, along with some insights on how Selly Africa can help:

Choose a payment processor: This is the backbone of your mobile payment system. First, find a credit card processor compatible with your POS software. Some ecommerce platforms have payment processing built in. For example, Selly Africa Payments can process transactions from most credit card issuers including, American Express, Visa, and Mastercard. Consider factors like transaction fees, integration ease, and features offered when making your choice.

Mobile-friendly checkout integration: Ensure your online store’s checkout process is optimized for mobile devices. This means a clean and responsive design with easy-to-use buttons and forms for entering payment details.

Mobile payment options: Integrate the chosen payment processor’s mobile payment options. These might include:

Mobile card readers: If you offer physical goods and deliveries, consider integrating with a mobile card reader solution. Your chosen payment processor might offer compatible readers or partner with a provider.

Mobile Wallets: Apple Pay, Google Pay, and Samsung Pay are popular options. These allow customers to complete transactions with a single tap, offering a convenient and secure checkout experience.

Sync your ecommerce software: Before setting your heart on a particular card reader, check that it integrates with your point of sale software.

Security measures: Prioritize PCI compliance and robust fraud prevention measures. Partner with a reputable payment processor that offers secure payment gateways and data encryption for customer peace of mind.

Testing and optimization: Thoroughly test your mobile payment integration on various devices and browsers to ensure a smooth checkout experience. Continuously monitor and optimize your mobile payment process to identify and address any potential issues.

Benefits of using Selly Africa for your business

Selly Africa, innovative mobile payment solution empowers entrepreneurs and small business owners to take credit card payments on-the-go, wherever their business takes them. For starters, you’ll be able to accept payments from a wider range of customers, increasing your sales and revenue potential. You’ll also save time and money by eliminating the need for cumbersome payment machines and reducing the risk of lost or stolen sales. Moreover, Selly Africa’s user-friendly interface and real-time analytics will give you greater insights into your business, allowing you to make data-driven decisions and optimize your operations for maximum efficiency. In addition, you’ll be able to focus on what matters most – growing your business and delighting your customers.

Case studies: Success stories of businesses using Selly Africa

When it comes to taking credit card payments on the go, Selly Africa has proven to be a game-changer for businesses across various industries. From small startups to established enterprises, our mobile payment solution has empowered entrepreneurs to expand their customer base, increase sales, and streamline their operations. Let’s take a look at a few inspiring case studies of businesses that have achieved remarkable success with Selly Africa. For instance, Nairobi-based fashion designer, Wambui Mwangi, was able to increase her sales by 30% after using Selly Africa to accept credit card payments at her pop-up events. Similarly, Kigali-based food vendor, Jean-Pierre Uwimana, saw a 25% increase in transactions after integrating Selly Africa into his mobile food cart. These businesses, and many others like them, have been able to tap into the vast potential of mobile payments, thanks to Selly Africa’s innovative and user-friendly solution. Selly Africa has enabled businesses to focus on what they do best – delivering exceptional products and services to their customers.

Conclusion

In conclusion, taking credit card payments on your phone has never been easier or more convenient. With Selly Africa, entrepreneurs and small business owners can now accept payments anywhere, anytime, and grow their business with ease. No longer are you limited by traditional payment methods or tied to a physical location. With Selly Africa, the possibilities are endless. Whether you’re a freelancer, a vendor at a market, or a small business owner, you can now focus on what you do best – providing excellent products and services to your customers.

Buying Stripe accounts has made managing payments much easier.

Thanks for your comment! We understand the desire for a streamlined payment process. However, buying verified Stripe accounts goes against Stripe’s terms of service and can be a security risk.

Selly Africa offers a safe and reliable way for businesses to accept credit card payments on their phones. It’s a great alternative that won’t compromise security. We’d be happy to answer any questions you have about Selly Africa and how it can benefit your business.