As the African ecommerce landscape continues to evolve, it’s essential to understand the diverse regions and markets that make up this vast and vibrant continent. With 55 countries, each with its own unique characteristics, preferences, and challenges, navigating the complexities of African ecommerce can be daunting. However, by recognizing the distinct regions and markets, you can tailor your payment strategy to meet the specific needs of your customers. From the tech-savvy consumers of South Africa and Nigeria, to the growing middle class of East Africa, and the Francophone markets of West and Central Africa, each region presents its own opportunities and obstacles. For instance, in North Africa, the Arab Spring has led to a surge in online shopping, driven by a young and educated population. Meanwhile, in West Africa, the informal economy remains a significant force, with cash-based transactions still dominant. By understanding the nuances of each region, you can adapt your payment gateway to accommodate local preferences, such as mobile money in East Africa or cash-based payment methods in West Africa. This localized approach will not only increase conversion rates but also build trust with your customers, ultimately driving growth and revenue for your ecommerce business. In this post, we’ll explore the transformative power of the right payment gateway, and how it can help African ecommerce businesses overcome the challenges of payment processing, expand their customer base, and thrive in a rapidly evolving digital landscape.

What is a payment gateway in ecommerce?

Imagine a virtual bridge between your online store and your customer’s bank account. That’s essentially what a payment gateway is. It acts as a secure intermediary that facilitates the authorization, processing, and settlement of online payments. When a customer makes a purchase, the gateway encrypts their sensitive financial information and transmits it to the relevant financial institutions (banks or credit card companies) for approval. Once approved, the funds are transferred from the customer’s account to yours.

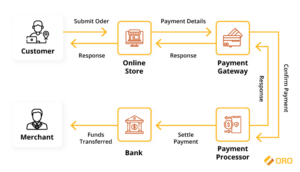

How does a payment gateway work?

Imagine you’re running a bustling online store. A customer clicks “buy now,” eager to secure that perfect pair of shoes. But how does their click on your website translate into cold, hard cash in your pocket? That’s where the magic of payment gateways comes in. Here’s a simplified breakdown of the payment gateway process:

- Customer Checkout: A customer adds items to their cart and proceeds to checkout on your online store.

- Payment Information Entry: The customer enters their payment details (credit card number, PIN, etc.) on a secure payment gateway form.

- Encryption and Transmission: The payment gateway encrypts the customer’s sensitive information to ensure security during transmission.

- Authorization Request: The encrypted data is sent to the customer’s issuing bank or credit card company for authorization.

- Authorization Response: The bank verifies the customer’s information and funds availability, then sends an authorization response back to the gateway.

- Transaction Processing: Upon successful authorization, the gateway captures the funds from the customer’s account.

- Settlement: The funds are transferred from the customer’s account to the merchant’s account (usually within a few business days).

- Confirmation: The customer and merchant receive confirmation of the successful transaction

The role of payment gateways in ecommerce growth

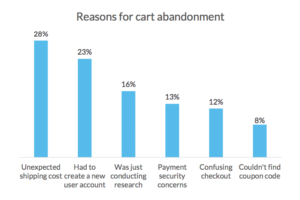

In the vast and diverse landscape of African ecommerce, payment gateways play a crucial role in facilitating online transactions and bridging the gap between businesses and consumers. A reliable and efficient payment gateway is the backbone of any successful ecommerce venture, enabling secure, fast, and convenient transactions that instill confidence in customers. Providing a seamless payment experience, payment gateways help to increase conversions, reduce cart abandonment rates, and ultimately drive business growth. Moreover, they offer a range of benefits, including fraud protection, payment processing, and currency conversion, which are essential for businesses looking to expand their online presence across the continent. With the right payment gateway, African ecommerce businesses can overcome the challenges of limited payment options, high transaction fees, and security concerns, unlocking a world of growth opportunities and paving the way for a thriving digital economy.

Payment gateways vs. Payment processors

The terms “payment gateway” and “payment processor” are often used interchangeably, but there’s a subtle difference.

- Payment Gateway: Acts as the storefront, handling the customer interface and securely transmitting information between the store and the processor.

- Payment Processor: Works behind the scenes, actually processing the transaction with the banks and credit card companies. They handle the authorization, settlement, and any potential chargebacks.

Think of it like this: the payment gateway is the waiter who takes your order at a restaurant (your online store), while the payment processor is the chef who prepares and delivers the food (processes the transaction). Some payment gateway providers also offer payment processing services, essentially acting as a one-stop shop for your online transactions.

Types of payment gateways

There are different types of payment gateways catering to various needs:

- Merchant Account Gateways: These are traditional gateways that require merchants to have a merchant account with a bank. They offer a wide range of features and security but can involve higher fees and setup costs.

- Payment Service Providers (PSPs): These gateways act as a one-stop shop, handling both authorization and settlement. They are often a good option for smaller businesses due to lower setup costs and easier integration.

- Mobile Wallets: Payment gateways like Apple Pay and Google Pay allow customers to pay directly from their mobile devices, offering a convenient and secure checkout experience.

Key features of a payment gateway for African ecommerce

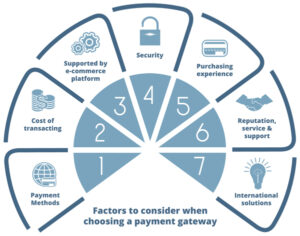

As the African ecommerce landscape continues to evolve, it’s crucial to identify the key features of a payment gateway that can support and fuel this growth. A payment gateway that’s tailored to the unique needs of African ecommerce must possess a combination of essential characteristics that cater to the diverse payment preferences and infrastructure of the continent. First and foremost, a payment gateway for African ecommerce must be able to support multiple payment methods, including card payments, mobile money, and bank transfers. This is critical in a region where cash is still king, and mobile money is increasingly becoming the preferred payment method. Additionally, the payment gateway should be able to handle multiple currencies, facilitating cross-border transactions and eliminating the complexity of currency conversions. Another vital feature is robust security and fraud protection. With the rise of online transactions, ecommerce businesses in Africa are increasingly vulnerable to cyber threats and fraudulent activities. A payment gateway that incorporates advanced security measures, such as 3D Secure, two-factor authentication, and machine learning-based fraud detection, can provide an additional layer of protection for businesses and their customers. Furthermore, a payment gateway for African ecommerce should be able to integrate with various ecommerce platforms, including Magento, Shopify, Selly Africa and WooCommerce, among others. This seamless integration enables businesses to effortlessly process payments and manage their online stores, without the need for complex technical configurations. Finally, a payment gateway that provides real-time analytics and reporting, as well as 24/7 customer support, is essential for ecommerce businesses in Africa. This allows businesses to track their transactions, identify trends, and make data-driven decisions to optimize their operations and improve customer satisfaction.

The payment gateway problem: A major challenge to ecommerce growth

The payment gateway problem is a significant obstacle that stands in the way of ecommerce growth in Africa. It’s a complex issue that has far-reaching consequences, affecting not only the merchant’s ability to receive payments but also the customer’s trust and confidence in online transactions. In many African countries, the lack of a reliable and efficient payment gateway infrastructure hinders the growth of ecommerce, making it difficult for businesses to process transactions securely and efficiently. The problem is multifaceted. On one hand, many African countries have limited access to traditional payment methods such as credit cards, making it difficult for merchants to accept payments from customers. On the other hand, the absence of a robust payment gateway infrastructure means that merchants are often forced to rely on cumbersome and unreliable methods, such as cash on delivery or bank transfers, which can lead to delays, errors, and even fraud. Furthermore, the payment gateway problem is exacerbated by the fragmented nature of the African market, with different countries having their own unique payment systems, regulations, and currencies. This makes it challenging for merchants to navigate the complexities of cross-border payments, leading to a lack of confidence in the ecommerce ecosystem as a whole. As a result, many African businesses are unable to reach their full potential, stuck in a cycle of limited growth and stunted development.

Overcoming payment gateway challenges in African ecommerce

As African ecommerce continues to boom, payment gateways have emerged as a crucial component in the online shopping experience. However, merchants and customers alike face a myriad of challenges that can hinder the seamless flow of transactions. From limited payment options to security concerns, high transaction fees, and inadequate currency support, the obstacles can be overwhelming. In some countries, the lack of credit card penetration, fragmented banking systems, and inconsistent internet connectivity further exacerbate the issue. Moreover, the diverse regulatory landscape across the continent can make it difficult for payment gateways to navigate the complex web of laws and regulations. To overcome these challenges, it’s essential to choose a payment gateway that is specifically designed to cater to the unique needs of African ecommerce, offering a secure, reliable, and user-friendly experience that can help merchants unlock their full growth potential.

Why African ecommerce needs a specialized payment gateway

The African ecommerce landscape is a complex tapestry of diverse cultures, languages, and currencies, woven together by a shared desire for growth and prosperity. However, this very diversity also presents a significant challenge for online businesses seeking to expand their reach across the continent. Traditional payment gateways, often designed with Western markets in mind, can struggle to accommodate the unique needs of African ecommerce. They may not support the numerous local currencies, or may not be equipped to handle the prevalence of cash-based transactions, mobile money, and other alternative payment methods that are ubiquitous in Africa. Furthermore, these gateways may not have the necessary infrastructure in place to navigate the varying regulatory requirements and fraud patterns that exist across different African countries. As a result, online businesses may find themselves hindered by high transaction failure rates, frustrated customers, and lost sales. This is why a specialized payment gateway, tailored to the specific needs of African ecommerce, is essential for unlocking growth and reaching the full potential of this burgeoning market.

The importance of cross-border payments in African ecommerce

As the African ecommerce landscape continues to evolve, the need for seamless cross-border payments has become a critical component of success. With the continent’s vast and diverse market, ecommerce businesses that can facilitate efficient and secure transactions across borders are poised to tap into a vast and lucrative customer base. In fact, according to a report by the International Monetary Fund, intra-African trade has the potential to increase by 15% to 25% by 2025, presenting a significant opportunity for ecommerce businesses that can navigate the complexities of cross-border payments. However, the reality is that many African ecommerce businesses struggle to overcome the hurdles of cross-border payments, including fragmented payment systems, high transaction fees, and limited payment options. This can lead to frustrated customers, abandoned carts, and lost sales. By integrating a reliable payment gateway that can facilitate cross-border payments, African ecommerce businesses can unlock new markets, increase revenue, and stay ahead of the competition. With the right payment gateway, businesses can expand their customer base, improve customer satisfaction, and ultimately drive growth and profitability.

Case studies: Successful African ecommerce businesses using the right payment gateway

The proof is in the pudding, as they say. While theory and statistics are important, there’s nothing quite like real-life success stories to drive the point home. In this section, we’ll delve into the experiences of several African ecommerce businesses that have cracked the code by integrating the right payment gateway into their operations. From Nigeria’s Jumia, which has leveraged its payment gateway to become the leading ecommerce platform in the region, to South Africa’s Takealot, which has seen a significant reduction in payment failures and increased customer satisfaction, the success stories are numerous and inspiring. We’ll also explore the journey of Kenya’s Selly Africa, an ecommerce platform that has used its payment gateway to provide seamless transactions for its customers, resulting in a substantial increase in sales and revenue. These case studies serve as a testament to the transformative power of the right payment gateway in African ecommerce. By overcoming the hurdles of payment processing, these businesses have been able to focus on what matters most – growing their customer base, expanding their product offerings, and ultimately, driving growth and profitability. Through these real-life examples, we’ll gain a deeper understanding of the strategies and approaches that have contributed to their success, and how other African ecommerce businesses can follow in their footsteps.

The future of African ecommerce: Trends and predictions

As the African ecommerce landscape continues to evolve, it’s essential to stay ahead of the curve and anticipate the trends that will shape the industry’s future. In the coming years, we can expect to see a significant shift towards mobile-first commerce, with more and more Africans turning to their mobile devices to make purchases online. In fact, a staggering 70% of Africans already access the internet solely through their mobile phones, making mobile optimization a critical component of any ecommerce strategy. Another trend that’s gaining traction is the rise of social commerce, with social media platforms transforming into virtual shopping malls. This presents a unique opportunity for African ecommerce businesses to leverage social media to reach a wider audience, build brand awareness, and drive sales. Furthermore, the growing demand for digital payments and online banking services is expected to continue, driven by the increasing adoption of mobile money and other digital payment methods. As a result, payment gateways that can facilitate seamless, secure, and convenient transactions will be essential for ecommerce businesses looking to capitalize on this trend. Finally, the African ecommerce industry is also likely to see a greater emphasis on sustainability and environmental responsibility, with consumers increasingly expecting businesses to prioritize eco-friendly practices and reduce their carbon footprint. By staying attuned to these trends and predictions, African ecommerce businesses can position themselves for long-term success and unlock the full potential of the continent’s rapidly growing online market.

Conclusion: Unlocking growth with a payment gateway

As African ecommerce continues to thrive, merchants are presented with a unique opportunity to tap into the continent’s vast and growing consumer market. However, to fully capitalize on this potential, it’s essential to implement a payment gateway that can effectively navigate the complexities of cross-border transactions. By doing so, merchants can unlock growth, increase customer satisfaction, and stay ahead of the competition. To achieve this, African ecommerce merchants must adopt a strategic approach to payment gateway integration. This involves selecting a payment gateway that not only supports multiple payment methods but also offers advanced security features, competitive pricing, and seamless integration with existing ecommerce platforms. Additionally, merchants must prioritize transparency, providing customers with clear and concise information about payment processing, fees, and transaction times. By adopting these best practices, African ecommerce merchants can create a seamless and secure payment experience that encourages customers to complete transactions, reducing cart abandonment rates and increasing revenue. Moreover, a reliable payment gateway can help merchants expand their reach, entering new markets and tapping into the vast potential of the African ecommerce landscape. By going beyond borders, merchants can unlock growth, increase their customer base, and establish themselves as leaders in the African ecommerce space.

Simplify operations with a customizable high-risk payment gateway.

Thanks for your comment! While Selly Africa doesn’t currently integrate with high-risk processors directly, we understand their importance for certain businesses. We offer a secure and user-friendly platform that can simplify operations for many businesses. Perhaps you could tell us more about your industry, and we can see if Selly Africa can still be a good fit

Aged Stripe accounts can offer stability for new businesses. Has anyone tried this?

Thanks for your comment! We can’t offer any guidance on using aged Stripe accounts, as they may not comply with regulations. Selly Africa focuses on providing solutions that adhere to best practices. We recommend exploring legitimate payment processing options for your new business.

The best merchant account options for high risk businesses are available on this platform, ensuring secure transactions.

Thanks for your comment! While Selly Africa prioritizes secure transactions, we currently don’t offer direct integration with high-risk payment processors. These processors cater to specific industries with unique needs. However, Selly Africa integrates with secure and popular payment gateways in Africa. Would you like to know more about our supported payment options?

Dependable high risk payment processing companies.

We understand the importance of dependable high-risk processing for some businesses. We’re currently exploring integrations with reliable processors to provide a more comprehensive solution in the future. Stay tuned for updates!

Considering buying Stripe accounts? Choose a reputable provider for hassle-free setup and compliance. Ensure secure payment processing with verified Stripe accounts.

Thanks for your comment! Stripe can be a great payment solution for some businesses. Selly Africa focuses on providing a secure and user-friendly platform for African businesses. We recommend exploring all available options to find the best fit for your needs

Great article! Your points on tailoring payment strategies for different African regions are crucial. Adapting to local preferences and ensuring robust security are key. At Poslinksolution.com, we focus on providing flexible, secure payment solutions that address these needs. Thanks for the insightful read!

Hello Olivia,

Thank you for your thoughtful feedback. Glad you found the article on tailoring payment strategies for different African regions insightful. At Selly Africa, we understand the importance of adapting to local preferences and ensuring top-notch security in payment solutions. It’s great to hear that Poslinksolution.com is also committed to providing flexible and secure payment options. Together, we can continue to empower businesses across the continent by addressing these vital needs. Thanks again for sharing your thoughts